Research on Equity Crowdfunding Accepted in the RAND Journal of Economics

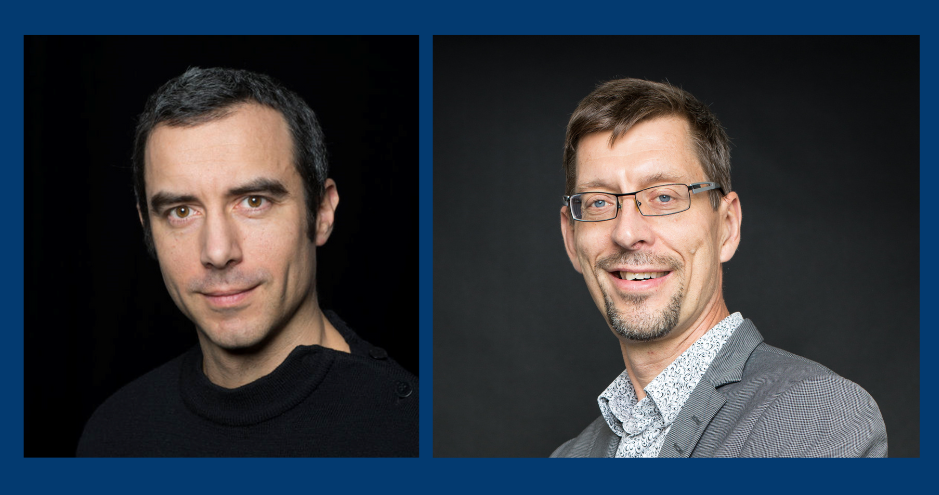

HEC Paris Professor of Finance Stefano Lovo has had his research paper “Herding in Equity Crowdfunding” accepted for publication in the RAND Journal of Economics, the leading journal in industrial organization. The research is in collaboration with Thomas Astebro, Professor of Entrepreneurship at HEC Paris, Manuel Fernández Sierra of the “Universidad de los Andes”, and Nir Vulkan of the University of Oxford.

Equity crowdfunding is an increasingly popular method of raising capital for a business by issuing shares of ownership to a large number of investors through dedicated online platforms. This allows entrepreneurs and startups to access a wide pool of capital from a larger number of investors. A typical crowdfunding campaign lasts 60 days and succeeds only if it raises a pre-announced goal amount. Some view equity crowdfunding campaigns as mechanisms that aggregate dispersed private information about startups’ fundamental values. This view is challenged by the idea that the crowd tends to behave as a herd and may be induced to invest irrationally, simply by seeing others invest.

In their research, the professors build a theoretical model of equity crowdfunding and test it using data on investors’ actual behavior in a leading UK based equity crowdfunding platform. They ask whether these campaigns can gather the wisdom of the crowd to finance startups with positive net present value and reject the negative net present value projects. They find that investors’ actual behavior reflects what was predicted by their theory, that is they are influenced by the investments of those who preceded them in the same campaign. Thus the momentum at the beginning of the campaign is crucial.

Campaigns that had too few investors at the launch might fail to take-off, as the investors who arrive later are discouraged by the lack of initial investment. Thus, it is possible for profitable startups not to be financed if campaign has an unlucky start. By contrast it is less likely for non-profitable startups to be financed via crowdfunding. Even after a lucky start, a negative NPV project will attract fewer and smaller investments, discouraging future investors to invest and preventing the campaign to reach the goal.

The RAND Journal of Economics, the leading journal in industrial organization, supports and encourages research in the behavior of regulated industries, the economic analysis of organizations, and more generally, applied microeconomics.

Find research digests from HEC professors on Knowledge@HEC.